Loan Resources

Loan Options

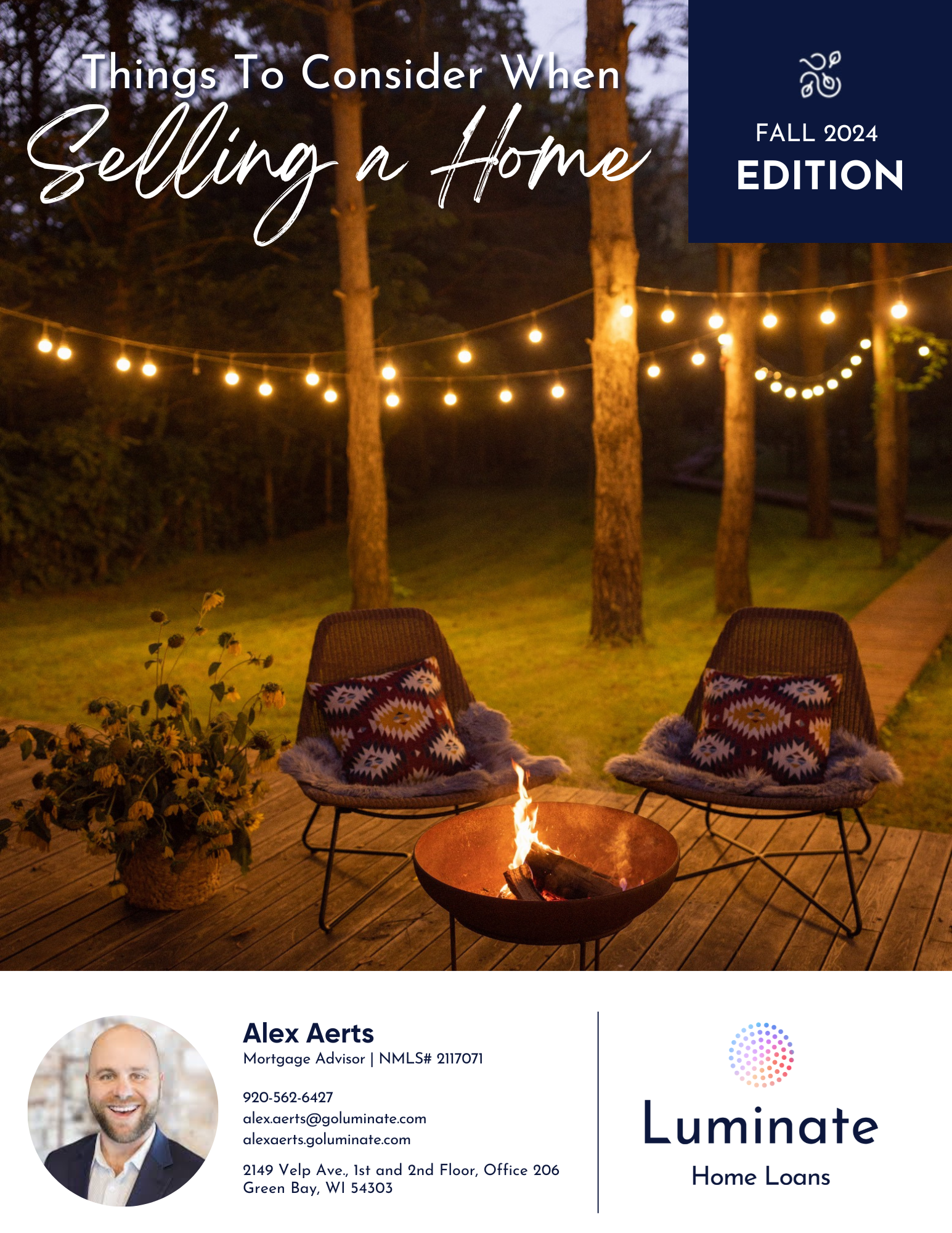

Alex Aerts at Luminate is always working hard to provide you with the best mortgage resources and financial advice possible. He and his team are fueled by a deep desire to help people, to get to know their clients, and to help those around them to grow and thrive.

Whether you're a first time home buyer, you're looking to refinance, looking for a trusted (and local) Wisconsin mortgage lender, or have any other unique financial situation, let Alex and his team help you understand all your options so you can get into the home of your dreams.

Items Needed for Pre-Approval

When you prepare for the pre-approval process, make sure you have these items ready to go to make things go faster:

- W2s from the last two years

- 1040 Federal Tax Returns from the last two years (all pages)

- Business tax returns and K1s (for business owners only)

- 2 most recent paystubs

- 2 months of recent statements for all assets (checking, savings, money market, retirement, etc.)

- Driver’s license or passport

- Other documentation we might need may include:

- Offer letter for employment, school transcripts, social security or pension award letters, divorce decree, bankruptcy papers, and short sale documentation

Mortgage Loan Process

The mortgage loan process can seem complex to many, but we'll work with you to guide you through every step so you never feel lost or overwhelmed.

1

First things first—apply for pre-approval via our "Apply Now" button at the top of this page!

2

Once we receive your requested documents, we'll schedule a time for us to meet. We'll review your mortgage options, talk about the home buying process, and issue your pre-approval.

3

Now the fun starts and you can start searching for your dream home!

4

Once you find a home and your offer is accepted, your interest rate will be locked in.

5

Next, we'll get your appraisal moving and title work will be ordered.

6

Once the appraisal and title work are complete, yourr loan will be sent to Underwriting Review.

7

When you receive final figures for closing, you know you're almost there!

8

And the final step—attend closing with your driver's license and receive the keys to your new home!

Calculate Your Monthly Payments

Have you ever been curious about what your monthly mortgage payment might be on a future home? Check out our great mortgage calculator tool to help start the conversation about homeownership!

Download Center

Welcome to our Download Center, where we provide you with all the resources you need to make informed decisions about your loans. We understand that the loan process can be overwhelming at every turn, which is why we've created a range of downloadable guides that can help you understand your options and make the right choices.

We encourage you to take advantage of the free resources we've created to help you achieve your financial goals. We're here to support you every step of the way!

Contact Us

Blog

Navigating the loan process can be overwhelming, but it doesn't have to be. Our blog is dedicated to providing you with valuable information and expert guidance to help you make informed decisions about your loans. Our team is committed to supporting you every step of the way. Browse our latest posts, and discover how to take control of your finances today.